Understanding Innocent Spouse Relief: Find Tax Resolution with House of Tax Representatives

Keep refunds and free yourself from debt that’s not yours by filing Innocent Spouse Relief

Are you burdened by a tax debt that resulted from your spouse's actions or mistakes? Innocent Spouse Relief could be the solution you've been seeking. At House of Tax Representatives, we specialize in providing expert assistance to clients who qualify for Innocent Spouse Relief. Let's delve into this vital IRS program and how our team can help you navigate the complex tax landscape.

What is Innocent Spouse Relief?

Innocent Spouse Relief is a tax relief program offered by the IRS for qualifying taxpayers. It provides a way for individuals to be relieved of their portion of a tax liability resulting from their spouse's erroneous actions or underreporting of income, fraudulent deductions, or other inaccurate tax claims. By proving your lack of involvement or knowledge regarding the understated tax, you can be released from the responsibility for that tax debt.

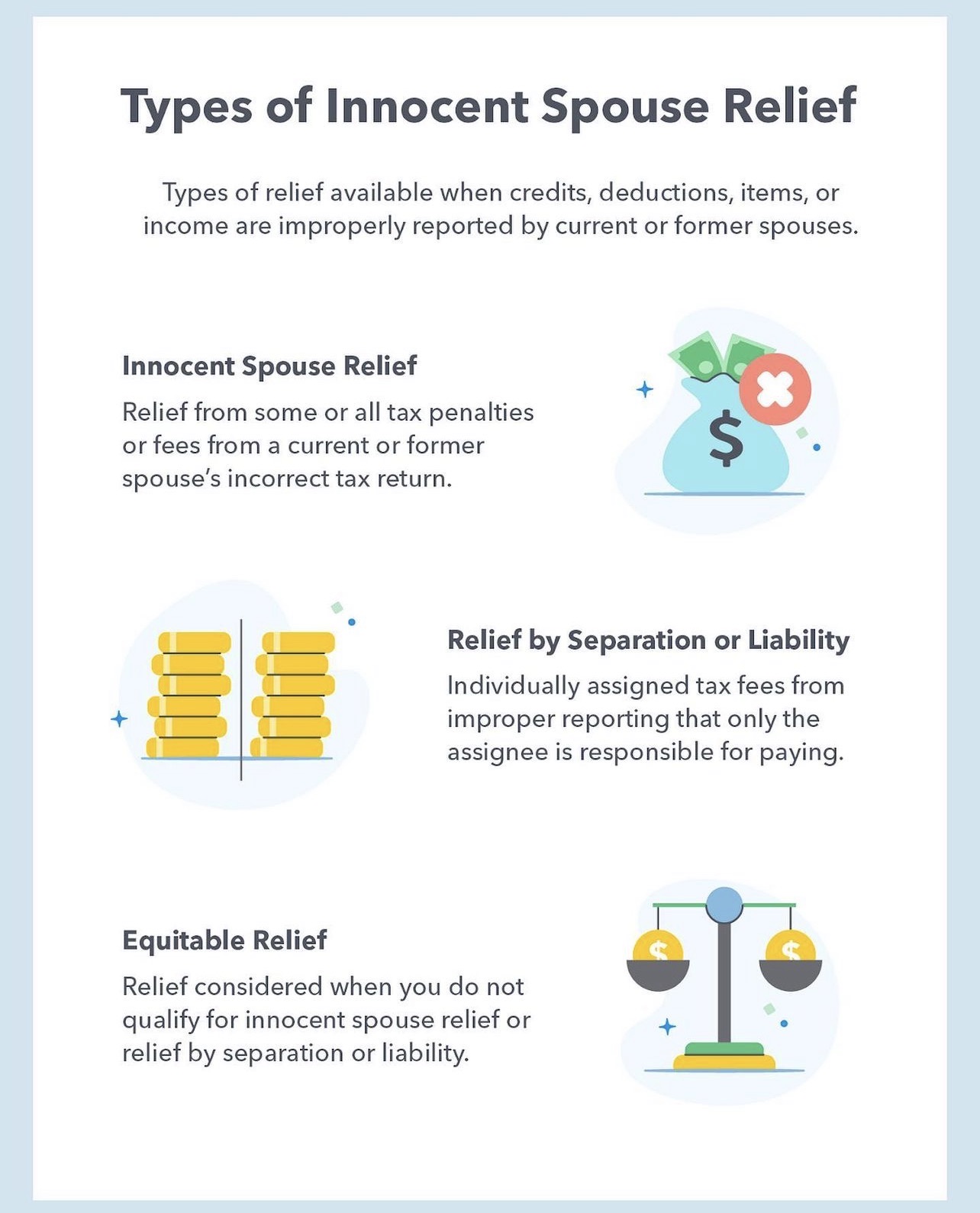

The Three Types of Spousal Tax Relief:

- Separation of Liability Relief: Under this relief program, the IRS divides the tax liability between you and your spouse. You are only responsible for the portion allocated to you, easing the burden of the overall debt.

- Injured Spouse Relief: If your tax refund is seized to satisfy your spouse's debt, such as child support, you may be eligible to recover your share of the refund through an injured spouse claim. This relief helps protect your portion of the refund from being used to offset your spouse's obligations.

- Equitable Relief: When you are ineligible for the other two relief options, equitable relief can come to your aid. By demonstrating to the IRS that it would be unfair to hold you liable for your spouse's tax debt, you may qualify for this relief program.

Qualifying for Innocent Spouse Relief:

To be eligible for Innocent Spouse Relief, you must meet certain requirements. Here are the key criteria:

- Joint Tax Return: You must have filed a joint tax return for the year(s) in question.

- Erroneous Items: The tax liability must have resulted from erroneous items reported by your spouse, such as unreported income or incorrect deductions, credits, or basis.

- Lack of Knowledge or Involvement: You need to demonstrate that you had no knowledge of the understated tax and did not participate in the erroneous reporting.

- Fairness: Considering all the facts and circumstances, it must be deemed unfair by the IRS to hold you responsible for the tax debt.

- Property Transfers: You and your current or former spouse should not have transferred any property to defraud the IRS.

How House of Tax Representatives Can Assist You:

Navigating the Innocent Spouse Relief process can be complex and overwhelming. That's where House of Tax Representatives comes in. Our experienced tax professionals specialize in assisting clients with their Innocent Spouse Relief requests. Here's how we can help:

- Expert Guidance: Our team understands the intricacies of the Innocent Spouse Relief program and will provide you with personalized guidance tailored to your specific situation.

- Accurate Documentation: We will ensure that all the necessary information and supporting documents are accurately prepared and included in your Innocent Spouse Relief request, increasing your chances of a successful outcome.

- IRS Communication: As your dedicated representatives, we will handle all communication with the IRS on your behalf, allowing you to focus on other aspects of your life while we work towards resolving your tax issues.

- Timely Resolution: While the IRS typically takes up to six months to make a decision on an Innocent Spouse Relief case, our proactive approach ensures that your case moves forward efficiently, expediting the resolution process.

Don't let your spouse's tax liabilities weigh you down. Seek the relief you deserve through Innocent Spouse Relief with the assistance of House of Tax Representatives. Contact us today to schedule a consultation and take the first step towards resolving your tax burdens and securing your financial future.